Three of a particular signature sneaker will hit stores and be dedicated to different partners. One of the reasons the price dropped is that Nike over the last few years will have a three colorway drop strategy. There are a variety of reasons this could have happened, but considering the sneaker didn’t have a release date until September 29th the shoe should have remained much higher. The second sneaker remained listed at $350 but had to be adjusted down as other sellers dropped the price back closer to the actual SRP. If the first two pair listed were purchased from a retail outlet early, where were the other pairs listing on StockX coming from? The sneakers weren’t at Nike stores (Factory, Unite, Employee or Clearance) so the pairs had to be coming from retailers with accounts or sellers were taking losses on the sneakers. The Trend of the XX and what to expect from the XX1Īs I mentioned, the first sale was exciting, but resale as an indicator only works if pairs of sneakers aren’t entering the market via wholesale. Almost immediately after the sneakers were listed other pairs showed up on the platform hinting at a trend which has shaped resale, the second pair sold on 9-21-2022 at $224.77 after fees. Two pair had been purchased and only two pair were available on the StockX site after getting a VIP representative to list the model. The first pair had a resale price of $317.59 after fees. Not many pairs were on the third-party market. At least I thought this was the case when I first discovered the LeBron XX Violet Frost on the shelves early. Nike at first glance seemed to be executing a controlled strategy perfectly. On 9-15-2022, the first sale of the early pair saw the $200 dollar SRP get shattered as anticipation was high. Why was excitement high at the onset? One retailer placed the sneaker out early because it didn’t show a release date. From the release of the Violet Frost XX to the final drop for the LeBron XX, the Mimi Plange colorway, any brand, retailer or resale platform can begin to recognize the importance of a pull vs push strategy especially when it comes to a premium priced, 200-dollar flagship sneaker.

This is important because the sheer number of styles Nike dropped paints a vivid picture of why the Lebron XX1 will follow the same pattern if Nike holds true to form.

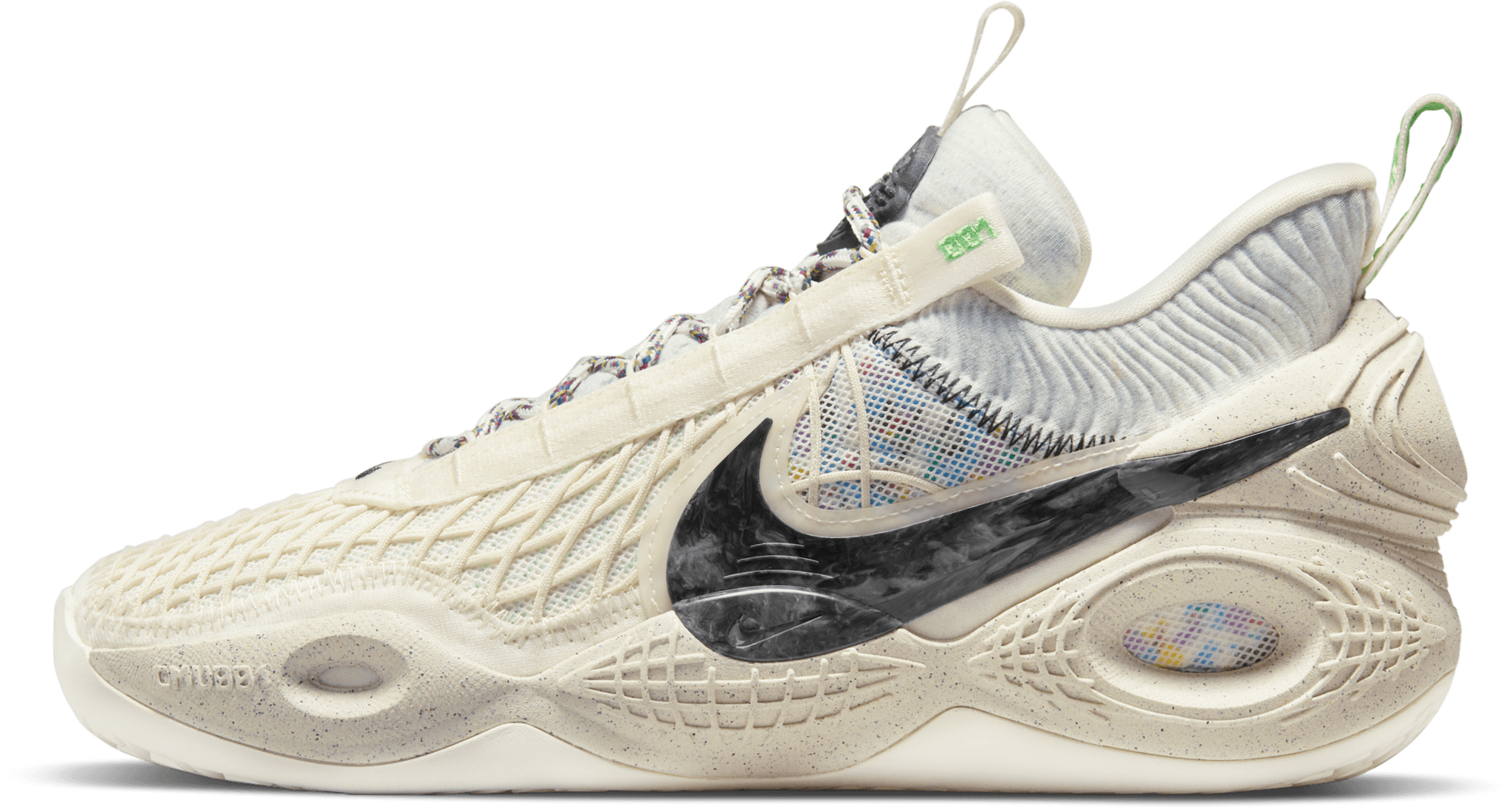

A quick explanation of this data: Utilizing resale as an indicator of brand heat and a micro-set of data from StockX, sales with dates from September 2021 to September 2023 features every style of LeBron released or available during this time (not just the XX). The most wearable LeBron in the history of the line was like a rocket coming out of the gate, but that quickly changed. I was right at first, but as Nike showed that the model would have a general release schedule with multiple colors dropping continuously, my thoughts on recapturing the moment for Nike Basketball were replaced with the reality of the market. The low-cut look wasn’t an unfamiliar style for LeBron, every year Nike has delivered a LeBron and a LeBron low version as well as a Soldier and a Witness (making LeBron the player with the most models… and this also comes into play with full-priced sell through) but the 20 looked so much like a Kobe, my initial thoughts were that the sneaker could revitalize the Nike Basketball segment. Nike continued the rollout of LeBron’s sneakers with a look consistent with the trend of Nike Basketball in a post Kobe world. LeBron carried the Lakers into the post-season in the 2022-23 year and appeared just as explosive as he was at the start of his career. Not many athletes are competing this late into their careers and doing so at a ridiculously high level. The sneaker isn’t the impressive aspect the athlete is. The latest LeBron is arriving for the King’s 21st season. The shoe is built to serve the next generation and is inspired by LeBron’s daughter, Zhuri. The LeBron XXI evolves the low-cut profile of the LeBron XX with premium lightweight materials modeled after the properties of an oyster shell.

0 kommentar(er)

0 kommentar(er)